Developing skills for the nuclear industry

In recognition of the pivotal role leadership plays in the nuclear industry, World Nuclear University stands at the forefront of leadership training, developing and delivering innovative, worldclass programmes that facilitate international partnerships and drive equity, inclusion and diversity of thought.

Our programmes inspire, empower, and connect generations of nuclear leaders.

In recognition of the pivotal role leadership plays in the nuclear industry, World Nuclear University (WNU) stands at the forefront, developing and delivering innovative, world-class programmes that facilitate international partnerships and drive equity, inclusion and diversity of thought.

"Attending a WNU programme is a once-in-a-lifetime opportunity to build a global network and lifelong friendships. It will shape your career by expanding your vision of the world and the industry."

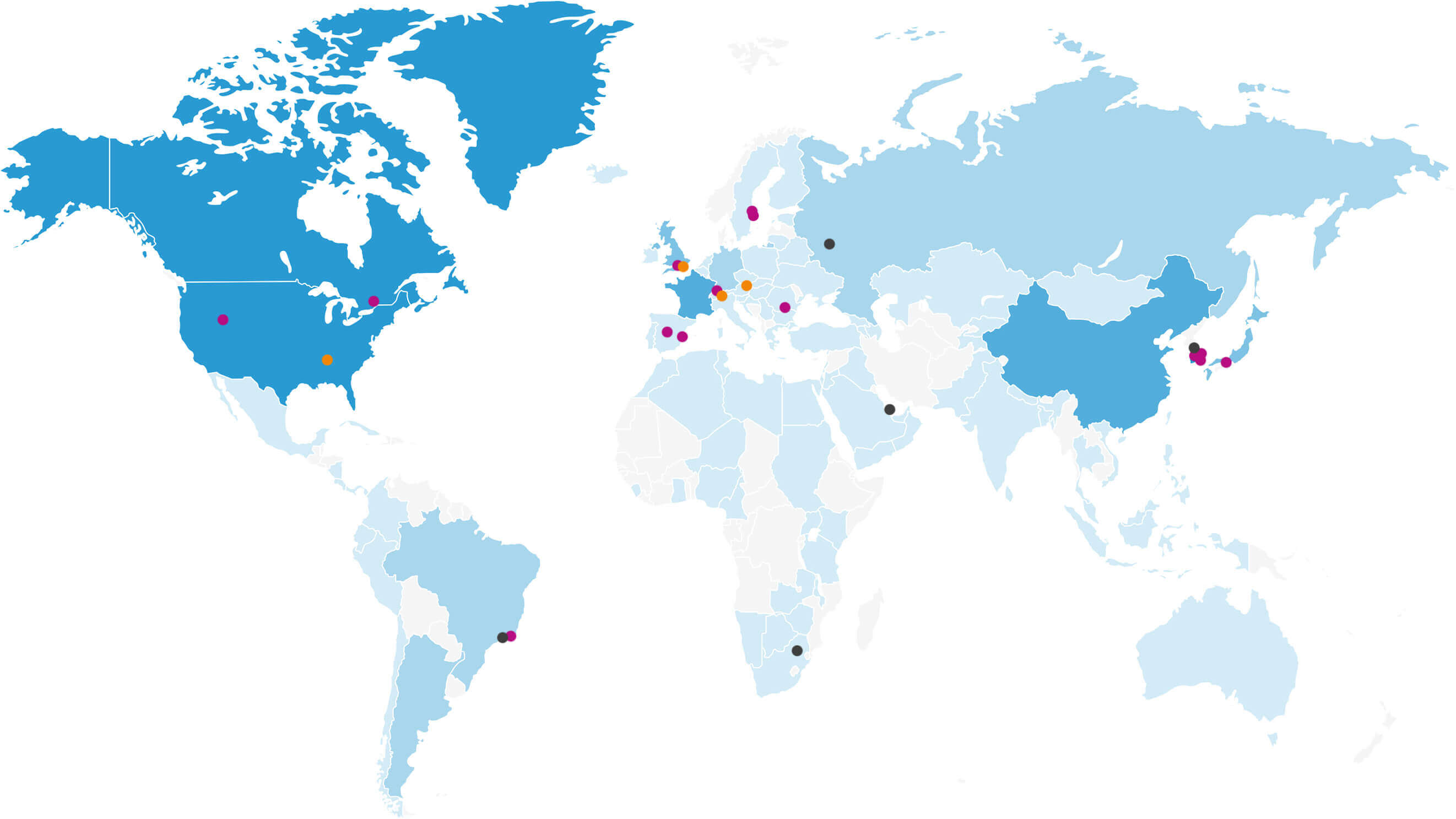

Our global

Alumni reach

Alumni reach

1633 Alumni*

Programmes & Activities

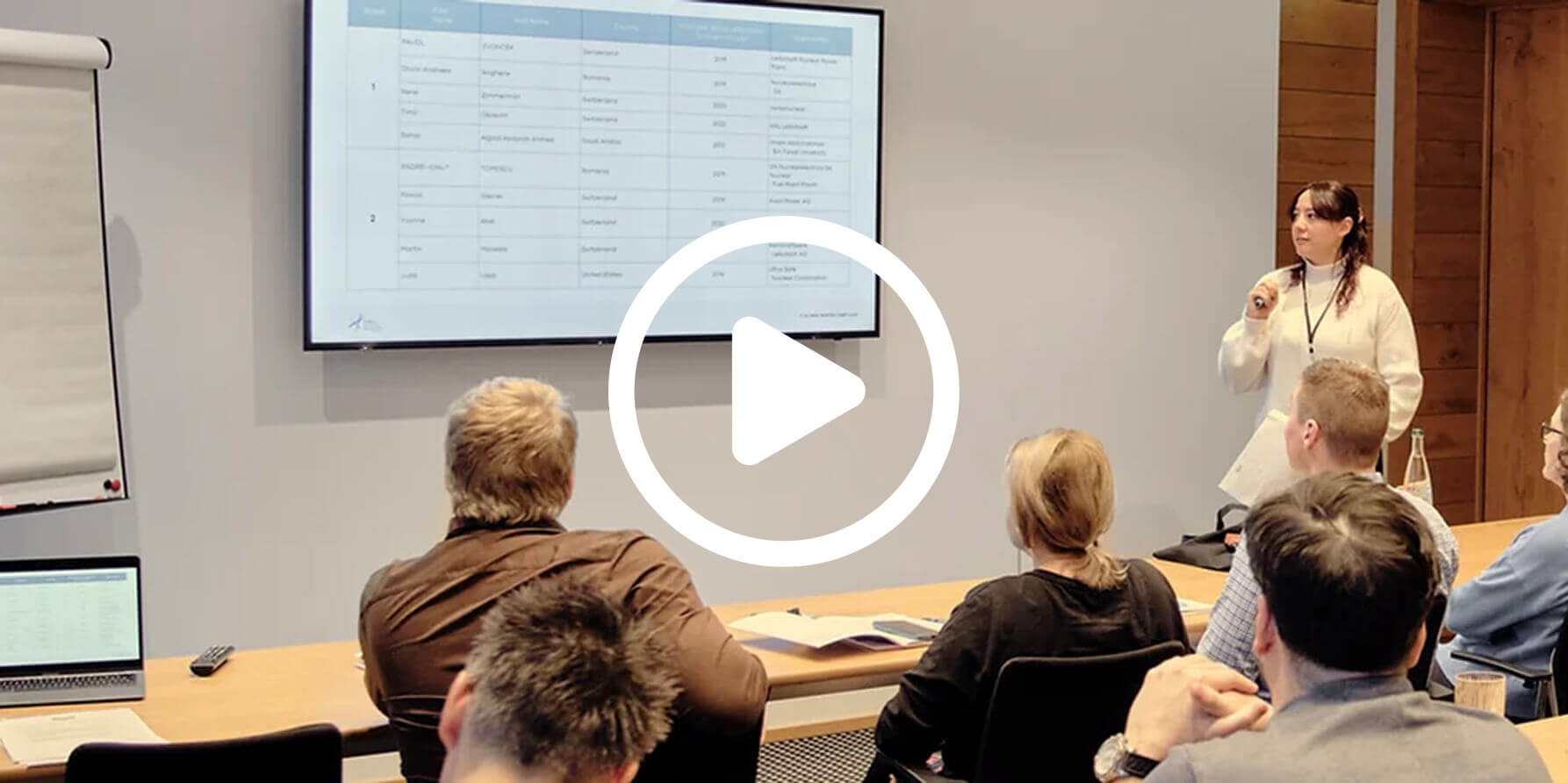

An immersive, five-week nuclear leadership and professional development programme.

1 Jun – 5 Jul 2025

Find out more